What really affects the cost of Hiring a Bookkeeper in 2025? (It's not just a number!)

Ready to Experience the +sup Difference?

Join hundreds of businesses that trust us with their financial management. Let’s discuss how we can help your business thrive.

Let’s talk about something that often feels like a mysterious black box for many business owners: the cost of getting your books in order.

You know you need someone reliable to handle the nitty-gritty financial stuff, but when you start looking, the price tags can swing wildly. In 2025, it’s more than just a simple hourly rate or a flat monthly fee. There’s a whole symphony of factors playing behind the scenes, and understanding them can save you a pretty penny (or help you budget smarter for top-tier help).

Mistake-proof your money with Automation:

So, let’s peel back the layers, shall we?

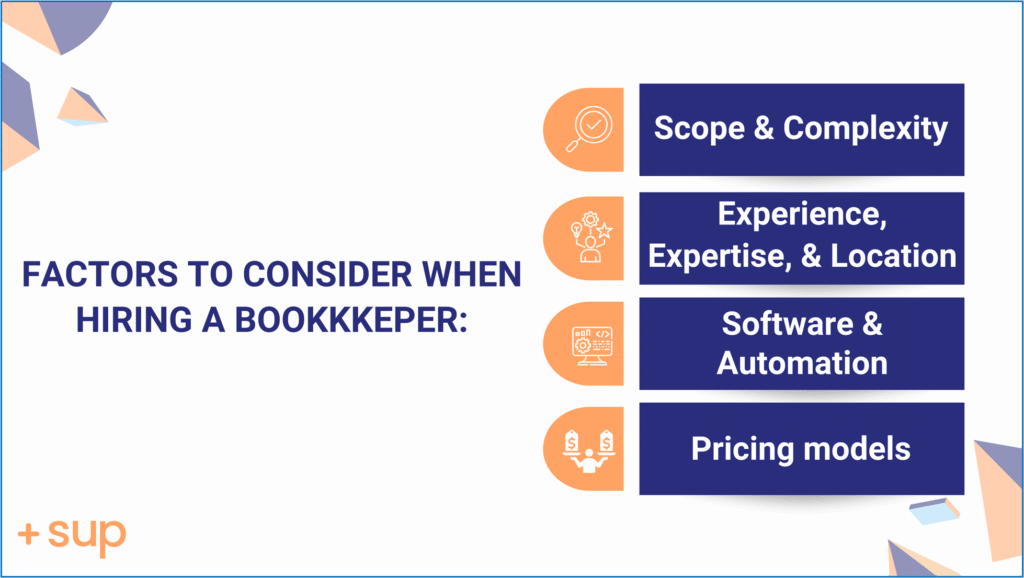

1.Your business's "messiness factor" (aka scope & complexity)

Honestly, this is probably the biggest piece of the puzzle. Think of it like this:

- How many transactions are we talking about? If you’re running a small online shop with a few dozen transactions a month, that’s wildly different from a manufacturing business with hundreds of invoices, multiple payment gateways, and international transactions. More transactions, more data entry, more reconciliation so more work, more cost.

- Are your books already a hot mess? If your shoebox of receipts is legendary and your last bank reconciliation was sometime during the previous decade, expect to pay a “cleanup” fee. Bringing order to chaos takes time, patience, and often more senior-level expertise. Starting with clean books? You’re already ahead of the game!

- What exactly do you need done? Just basic categorizing and bank reconciliations? Or do you need payroll processing, accounts payable/receivable management, sales tax filing, financial reporting for investors, budgeting, forecasting, or even a bit of advisory work? The more services you pile on, the higher the cost. Basic bookkeeping is one thing; becoming your go-to financial co-pilot is another.

- Transaction Specifics: The cost of your bookkeeper also increases with transaction specifics. This includes the unique complexities of Crypto/On-Chain Activity, the detailed tracking required for Inventory, and the varied income streams from Non-Subscription or Usage-Based Revenue. Similarly, Lending Businesses demand a highly specialized approach. Essentially, the more intricate or unique your financial movements, the more comprehensive (and thus, more costly) the bookkeeping support becomes.

- Industry Specifics: Some industries are just naturally more complicated. Think healthcare with all those compliance rules, construction with job costing, or e-commerce with huge volumes and returns. If your bookkeeper needs specific industry knowledge or software expertise (like QuickBooks for Contractors or specific SaaS billing platforms or industry specific PoS), that specialized skill set commands a higher rate.

2.The human element: Experience, Expertise, & Location:

Just like any profession, not all bookkeepers are created equal.

- Experience level & Expertise: A junior bookkeeper fresh out of school is going to cost significantly less than a seasoned “full-charge” bookkeeper who’s seen it all and can practically read your mind (or at least your financial statements). Certifications (like a Certified Bookkeeper or even a CPA, if they’re offering bookkeeping services) also play a big role. You’re paying for their wisdom and ability to catch things before they become huge problems.

- Location (Remote vs. In-person): Ah, the WFH revolution! While remote bookkeeping often can be more cost-effective (no office space, fewer overheads for the bookkeeper), don’t assume it’s always drastically cheaper. Highly skilled remote bookkeepers, especially those with niche expertise, still command competitive rates because they’re not limited by geography. However, if you’re open to outsourcing to, say, talent in lower cost-of-living countries like India (where we are, by the way!), you might find some seriously attractive rates for high-quality work. It’s all about accessing a wider talent pool with the right expertise.

3.The tech factor: Software & Automation:

We’re in 2025, and technology is, like they say, a game-changer.

- Your software stack: If you’re already on a prominent, integrated cloud accounting system (think QuickBooks Online, Xero, Zoho Books), it can actually make a bookkeeper’s life easier and potentially reduce their time spent, thus lowering costs. If you’re still on ancient desktop software or, gasp, spreadsheets for everything, it might take more effort (and cost) for them to navigate.

- Automation tools: Good bookkeepers embrace automation. Tools for receipt scanning (like Dext or Hubdoc), automated transaction categorization, and seamless bank feeds mean less manual data entry. If a bookkeeper leverages these, they can be more efficient, and often that efficiency translates into more competitive pricing for you. They’re spending less time on tedious tasks and more on analysis (which is where the real value often lies).

4.Pricing models: hourly, fixed, or value?

How you’re charged also makes a big difference:

- Hourly rates: The old classic. Simple, straightforward. You pay for the hours they work. This can be great for one-off projects or if your needs fluctuate, but it can also feel a bit open-ended if you’re worried about hours racking up.

- Fixed monthly fees: This is super popular now. The bookkeeper assesses your needs and offers a flat monthly fee. This gives you predictability and budget certainty, which is a huge relief for many business owners. The bookkeeper aims for efficiency to make their margin here.

- Value-based pricing: This is the new kid on the block (well, well, not that new, but gaining traction). Here, the price isn’t just about time spent or transactions. It’s about the value the bookkeeper brings to your business like the insights, the money saved, the peace of mind. This often comes with more advisory services and higher-level strategic input. You’re paying for outcomes, not just tasks.

So, how can Sup simplify this?

Understanding and walking through this complex situation can feel like a full-time job, especially when you’re trying to directly hire an individual. This is where a dedicated finance and bookkeeping service provider like us at Sup steps in to streamline everything for you. We’re not just offering a service, we’re offering a comprehensive solution that helps you optimize costs and gain efficiency. As the motto at Sup goes: “We support busy founders by efficiently managing their accounts and finances, saving them precious time to focus on what matters most – Growth.”

Here’s how partnering with Sup can make a real difference:

- You get a team, not just an individual: Instead of hiring one person who might have a limited skill set or get overwhelmed, with Sup, you tap into a diverse team of financial professionals. This means you get the right level of expertise for each task like a junior for data entry, a senior for complex reconciliations, and an experienced professional for strategic reporting or cleanup. This efficiency prevents you from overpaying for high-level expertise on basic tasks.

- Predictable, transparent pricing: Forget the hidden costs of hiring an employee (benefits, training, software licenses, sick days). We offer clear, fixed-fee packages or value-based pricing tailored to your specific needs, based on the complexity and volume of your transactions. This provides budget certainty, no surprises.

- Built-in technology & automation: We come equipped with the latest cloud-based accounting software and automation tools. You don’t need to invest in expensive licenses or train staff on new systems. We leverage these technologies to ensure maximum efficiency, faster turnaround times, and fewer manual errors, directly impacting your cost savings.

- Scalability & flexibility: As your business grows, your bookkeeping needs change. Hiring and firing is painful. With Sup, we scale our services up or down based on your current volume and requirements without you having to worry about staffing changes, training, or turnover.

- No overhead, no HR headaches: You avoid all the administrative burdens and costs associated with employment- no payroll taxes, no benefits, no office space, no managing performance reviews. You just get the results.

The bottom line: A good bookkeeper is an investment, not just an expense.

Look, investing in professional bookkeeping isn’t just another bill to pay. It’s an investment in the financial health and future of your business. A good bookkeeping solution, like what Sup provides:

- Saves you time: Time you can spend on growing your business or, you know, sleeping.

- Prevents costly mistakes: Catching errors before they become tax nightmares or cash flow crises.

- Provides insights: Giving you clean, accurate data so you can actually understand your business’s performance.

- Keeps you compliant: Navigating the ever-changing world of taxes and regulations.

So, when you’re considering the cost, don’t just see a number. See the value, the peace of mind, and the robust financial foundation it builds for your business’s success. With a partner like Sup, you get expert support customised to your needs, ensuring your books are beautiful and your budget happy. In fact, many find that Sup delivers a truly result oriented pricing structure, ensuring every penny spent translates into unparalleled service and tangible benefits, setting us apart from even larger corporate services like Bench and Pilot.

Ready to experience the Sup difference?

Don’t just take our word for it, instead try us out risk-free!

We’re so confident in the value we provide that if you’re not completely satisfied within 30 days, we’ll either make it right or refund 100% of your money.

Ready for a free consultation to see how we can transform your finances? Just drop us a message at hello@thesupservices.com, and we’ll schedule a call with our Founders to discuss your needs.

Discover the Sup difference

We know that finding the perfect bookkeeper can feel like searching for a needle in a haystack. That’s where Sup comes in. Our dedicated team are designed to make finding and working with a top-tier bookkeeping service incredibly easy and effective.

We can help you:

- Access expert bookkeepers: Our team comprises experienced professionals vetted for their skill and reliability.

- Certification: At Sup, we’re proficient in a wide range of bookkeeping platforms, including QuickBooks, Xero, Zoho Books, Wave, and many more, which ensures we’re compatible with any kind of help you need.

- Implement an organized financial system: Customized to your unique business needs, making sure every transaction has a home.

- Streamline your financial operations: From expense tracking to generating crucial reports, we make it all seamless.

- Gain financial clarity: We help you understand your numbers so you can make informed decisions for growth.

- Pricing: Our pricing offers a distinct advantage, often 50% less than what you’d find with other virtual bookkeepers like Bench, Pilot, Furey, and Zeni, all while exceeding your expectations for quality.

- With Sup on your side, you can stop worrying about your books and start focusing on what truly excites you – running and growing your small business.

Let’s talk about how Sup can connect you with an expert bookkeeper to simplify your financial management!

Ready to Transform Your Financial Management?

Let our expert team handle your bookkeeping, data automation, and visualization needs while you focus on growing your business.