How to Hire the Right Bookkeeper for a Small Business

Ready to Experience the +sup Difference?

Join hundreds of businesses that trust us with their financial management. Let’s discuss how we can help your business thrive.

Keeping your small business finances in tip-top shape might not be the most thrilling part of your day, but it’s absolutely essential. Think of it like building the strong, silent foundation of a skyscraper – crucial for everything that goes on top. We often see busy small business owners trying to juggle it all, and sometimes, the books take a backseat. So, let’s walk through how to find that perfect bookkeeper who can be your financial wingman.

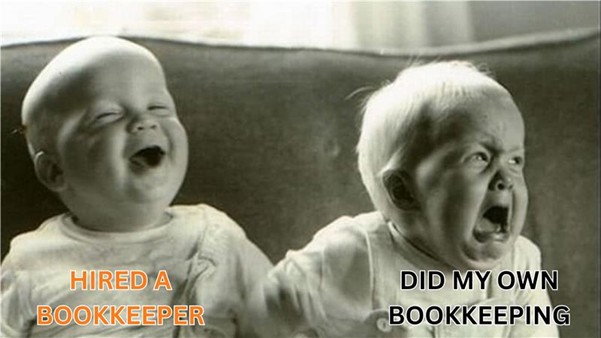

Thinking of handling your own books? Here's why you might reconsider:

You might be thinking, “Can’t I just use some software and do it myself?” And the short answer is: you could, but why would you want to? Hiring a professional bookkeeper isn’t just about handing off tasks, it’s about safeguarding your business and freeing up your precious time for what truly matters – Growing your business.

The upsides you can expect:

- Reclaim your time: Stop drowning in receipts and spreadsheets. A good bookkeeper takes on the tedious, time-consuming tasks of data entry, bank reconciliation, and expense tracking.

- Accuracy you can trust: Mistakes in your books can lead to big headaches, from incorrect tax filings to missed financial opportunities. Professionals ensure your records are precise and reliable.

- Smarter financial decisions: With clean, up-to-date books, you’ll have a clear picture of your cash flow, profitability, and where your money is actually going. This insight is gold for strategic planning.

- Stress reduction: Let’s face it, financial worries can keep you up at night. Handing off your bookkeeping to an expert means one less thing on your plate and a whole lot more peace of mind.

- Tax readiness: Come tax season, you won’t be scrambling. Your bookkeeper ensures all your financial data is organized and ready, making tax filing a breeze and helping you capture every eligible deduction.

Spotting your perfect Financial Partner: Key traits to seek out

Now, how do you find this magical person? While every business is unique, there’s a core set of qualities that almost all small business owners should seek in their bookkeeping partner.

A foundation of knowledge: This isn’t just about someone who knows how to use a calculator.

- Proven track record: Look for experience, especially with other small businesses or ideally, within your industry. They should understand the unique financial rhythms and challenges of businesses like yours.

- Qualifications: While formal certifications aren’t always required, they can be a good indicator of dedication and knowledge.

Tech-savvy & tool-ready: Your bookkeeper needs to be fluent in the tools you use.

- Master of your chosen platform: Whether it’s QuickBooks, Xero, FreshBooks, or something else, ensure they’re proficient. Bonus points if they can advise on the best accounting software for your needs.

- Cloud-savvy: In today’s world, online bookkeeping services are common. They should be comfortable working in cloud environments, making collaboration easy and secure.

More than just numbers: effective communication: Beyond the numbers, they need to connect.

- Clarity over jargon: Can they explain complex financial concepts in a way you understand? You don’t want someone who just spews accounting terms.

- Responsiveness: You’ll have questions. You need a bookkeeper who’s reachable and communicates promptly.

The cornerstone of trust: This is non-negotiable.

- Confidentiality: You’re giving them access to your most sensitive financial data. They must be discreet and ethical.

- References: Always check them! Past clients are your best source of honest feedback.

Anticipating your needs: The proactive edge: Your bookkeeper should be more than a data entry clerk.

- Problem-spotter: They should be able to flag potential issues, suggest efficiencies, and help you improve your financial processes.

- Insight provider: The best bookkeepers don’t just record; they help you interpret your financial reports to make better decisions.

Your hiring playbook: Simple steps to success

The process doesn’t have to be complicated.

- Define your needs: What specific tasks do you want them to handle? (e.g., payroll, invoicing, expense tracking, monthly reports).

- Craft a clear job description: Be specific about responsibilities and required skills.

- Interview thoughtfully: Ask scenario-based questions to see how they approach common bookkeeping challenges.

- Check those references: A quick call can save you a lot of grief later.

- Consider a trial period: A short-term engagement lets you test the waters for compatibility and performance.

Discover the Sup difference

We know that finding the perfect bookkeeper can feel like searching for a needle in a haystack. That’s where Sup comes in. Our dedicated team are designed to make finding and working with a top-tier bookkeeping service incredibly easy and effective.

We can help you:

- Access expert bookkeepers: Our team comprises experienced professionals vetted for their skill and reliability.

- Certification: At Sup, we’re proficient in a wide range of bookkeeping platforms, including QuickBooks, Xero, Zoho Books, Wave, and many more, which ensures we’re compatible with any kind of help you need.

- Implement an organized financial system: Customized to your unique business needs, making sure every transaction has a home.

- Streamline your financial operations: From expense tracking to generating crucial reports, we make it all seamless.

- Gain financial clarity: We help you understand your numbers so you can make informed decisions for growth.

- Pricing: Our pricing offers a distinct advantage, often 50% less than what you’d find with other virtual bookkeepers like Bench, Pilot, Furey, and Zeni, all while exceeding your expectations for quality.

- With Sup on your side, you can stop worrying about your books and start focusing on what truly excites you – running and growing your small business.

Let’s talk about how Sup can connect you with an expert bookkeeper to simplify your financial management!

Ready to Transform Your Financial Management?

Let our expert team handle your bookkeeping, data automation, and visualization needs while you focus on growing your business.