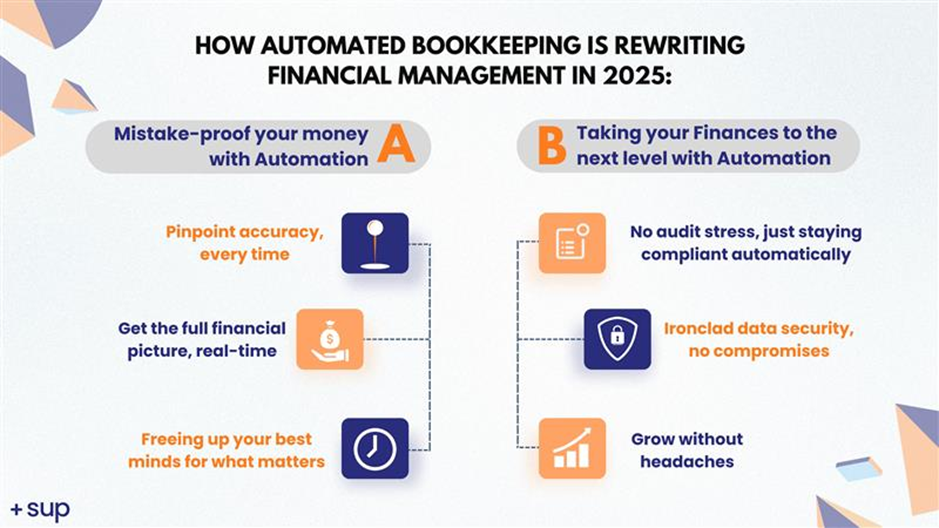

How Automated bookkeeping is rewriting Financial Management in 2025:

Ready to Experience the +sup Difference?

Join hundreds of businesses that trust us with their financial management. Let’s discuss how we can help your business thrive.

Ever feel like your business’s financial engine is always running on fumes, constantly playing catch-up?

In 2025, that feeling is becoming a relic of the past, thanks to a quiet revolution driven by automation and artificial intelligence (AI). For any business striving for real efficiency, serious scalability, and genuinely real-time financial insights, sticking to old-school manual bookkeeping is frankly like trying to win a race with a horse and buggy.

Here at Sup, an ever so supportive provider of financial services right across India, we’re seeing it firsthand: automated bookkeeping solutions aren’t just making things a bit smoother, they’re completely redrawing the map for corporate finance and financial operations. This isn’t just about punching numbers faster, it’s about unveiling a whole new level of strategic financial decision-making.

Mistake-proof your money with Automation:

To be entirely honest, the sheer volume and speed of today’s financial transactions are just too much for human hands alone. In 2025, if you want your business to have truly robust financial health, automated bookkeeping solutions aren’t a nice-to-have, they’re essential.

- Pinpoint accuracy, every time– Think about it, how many little errors creep in with manual data entry? Those tiny mistakes can snowball into big discrepancies, delayed reconciliations, and even costly compliance headaches. But with automated accounting software, powered by smart Machine Learning (ML), every single transaction is meticulously recorded and categorized. This means financial reporting gets a massive boost in accuracy, giving you consistently reliable financial data. If you’re looking for real cost savings and genuine peace of mind, that level of precision is simply invaluable.

- Get the full financial picture, real-time. Imagine knowing exactly where your cash flow stands, how your profitability is trending, and seeing all your key performance indicators (KPIs), literally moment by moment. That’s what real-time financial data automation delivers. Instead of waiting anxiously for month-end closes, you can now pull up dynamic dashboards that give you instant visibility into your financial performance. This rapid access to actionable intelligence lets you make quick, smart decisions, adapting on the fly to market shifts or unexpected opportunities. In today’s fast-moving economy, that kind of agility in optimizing financial operations is non-negotiable.

- Freeing up your best minds for what matters: This is one of the biggest, often un-appreciated, wins for automated bookkeeping: how it empowers your people. By letting the machines handle repetitive, time-consuming tasks like invoice processing, expense management, and bank reconciliation, your finance team is liberated from the daily grind. This means they can finally step up to higher-value activities:

- Digging deep into financial analysis

- Crafting brilliant strategic financial planning

- Spotting potential risks (and opportunities!)

- Sharpening your forecasting and budgeting

- Uncovering new avenues for growth

Imagine your finance experts not just processing but truly advising and driving your company’s strategic goals. That’s the power of automation.

Taking your Finances to the next level with Automation

- No audit stress, just staying compliant automatically: The world of financial regulations is always changing, and keeping up can feel like a full-time job, trust us, WE KNOW! Automated bookkeeping systems, especially when teamed up with clever Regulatory Technology (RegTech), are a fantastic solution. They can automatically track new rules, flag any potential compliance slip-ups, and even generate those automated reports for tax authorities. This ensures you’re always aligned with RBI and SEBI regulations here in India, helping you avoid headaches and penalties which are critical for financial institutions and all kinds of corporations.

- Ironclad data security, no compromises: As our financial processes become more digital, keeping your data safe is paramount. Modern cloud-based accounting solutions aren’t messing around, they use tough encryption, strict access controls, and regular security checks to protect your sensitive financial information. When you’re dealing with your money, knowing your provider puts robust cybersecurity protocols first is just plain smart business.

- Grow without headaches: Whether you’re a startup rocketing upwards or an established enterprise, automated bookkeeping is built to grow with you, really. These systems effortlessly handle more and more transactions without you needing to constantly add more manual staff or hours. It’s the perfect backbone for businesses with big growth plans, making sure your financial management infrastructure expands smoothly right alongside your company.

How Sup can help:

Sup truly believes that real financial transformation happens when smart technology meets brilliant human expertise. Our approach to automated bookkeeping goes way beyond just installing some software. We combine the raw power of AI, Machine Learning, and Robotic Process Automation (RPA) with our deep understanding of financial services. This means we can offer you:

- Custom solutions: We don’t do one-size-fits-all. We build automation workflows that perfectly fit your unique business model and whatever specific industry challenges you face, say from complex debt broking compliance to detailed e-commerce reconciliation.

- Expert human touch: Our team of certified finance professionals provides that essential human oversight. They’re there to interpret the automated insights, handle those tricky exceptions that tech alone can’t manage, and give you the strategic guidance you need.

Complete financial mastery: From automating your accounts payable to sophisticated financial forecasting, we offer a full suite of financial solutions designed to make your entire finance function smarter and more effective.

Ready to future-proof your finances?

So, the future of money for businesses is looking super automated, smart, and totally on point for strategy, right? But is your business geared up for that?

If you’re wondering how to get your finances in shape for what’s next, why not schedule a free consultation call with us today?

In a personalized 30-minute chat, our experts will:

- Get to know your unique business needs and financial pain points.

- Understand what’s most important to you in a bookkeeping solution.

- Show you firsthand how Sup’s intelligent, automated solutions can streamline your accounting.

Get all your questions answered and discover how Sup brings clarity and efficiency to your financial future. Reach out to us today to book your consultation!

Ready to Transform Your Financial Management?

Let our expert team handle your bookkeeping, data automation, and visualization needs while you focus on growing your business.