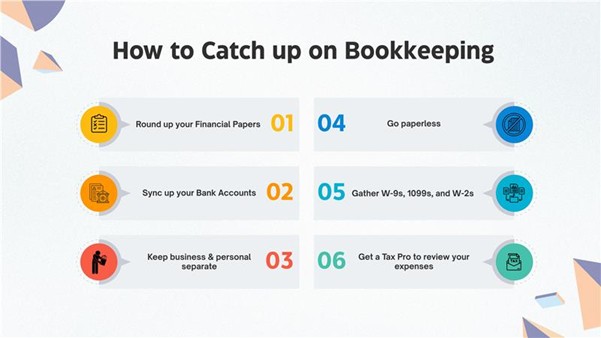

How to Catch up on Bookkeeping

Ready to Experience the +sup Difference?

Join hundreds of businesses that trust us with their financial management. Let’s discuss how we can help your business thrive.

Sometimes, keeping your small business finances perfectly up-to-date can feel like a mountain, and a backlog can quickly build up. While Sup offers a fantastic Catch-Up Bookkeeping Service to handle this for you, we get that some business owners really want to tackle their overdue books themselves.

If that’s you, no worries! Here’s a clear, step-by-step process you can use to power through that bookkeeping backlog and get your finances back in shape.

Step 1: Round up your Financial Papers

Your first mission: gather every single receipt and invoice tied to your business spending. Think of it like collecting all the pieces of a puzzle.

Here are the key types of records you’ll want to dig out:

- Customer invoices: Double-check your customer records to ensure you have all invoices issued for the tax year. If your business uses the cash basis accounting method, you record income only when you actually receive the cash. For example, if you made a $1,000 sale in October 2024 but weren’t paid until February 2025, you’d record that income in February. However, with the accrual basis accounting method, you record the amount the moment the sale happens, even if the money hasn’t arrived yet. In that same example, under accrual basis, you’d recognize the $1,000 revenue right away in October.

- Debt collections: Check your customer accounts for any bad debt. If you use accrual basis accounting and a customer doesn’t pay you for work done, you might be able to write this off as a bad debt expense. To deduct this from your tax return, you’ll need to show the IRS you’ve tried hard to collect the money but couldn’t. Typically, bad debts reduce your business’s gross income for tax purposes. You can claim them using either the specific charge-off method (deducting a specific bad debt that becomes partly uncollectible during the year) or the non-accrual experience method (deducting income from gross income if you couldn’t collect the debt).

- Business expenses: Gather all receipts from every business purchase made during the tax year. You can also use a comprehensive list of small business tax deductions (like ones you find on the IRS website or from a tax pro) to make sure you’re tracking and claiming everything you’re entitled to.

- Vendor accounts: Look over your vendor accounts to ensure you’ve paid them in full. Make sure you have a copy of every bill from each vendor activity. If you don’t have one, reach out to the vendor right away to get a copy. This includes bills for business activities that are still ongoing during your business’s closing period, just to make sure these expenses appear on your year-end financial statement.

Step 2: Sync up your Bank Accounts

It’s super important to reconcile your bank accounts.

Why? So you can catch any errors in your company’s records or even the bank’s. You’ll compare each transaction on your bank statement with the matching transaction in your business’s accounting records. The goal is to make sure the balance in your bank statement and your company records match up perfectly. If they don’t, find and fix those errors.

Handing over unreconciled accounts to your bookkeeper or accountant can actually cost you more. If they have to spend extra time fixing your books, you’ll see those charges on your bill. By reconciling your accounts beforehand, you’re saving both your financial pro and yourself valuable time and money.

Step 3: Keep business and personal separate

We always tell our clients this: keep your personal and business expenses strictly separate. Mixing personal and business funds in the same account is called piercing the corporate veil. If you do this, especially as a corporation or LLC, you could lose the liability protection your company structure offers. That means you might become personally responsible for your business’s debts and actions – definitely something you want to avoid!

Managing mixed personal and business expenses is also a major headache when it’s time for taxes or regular bookkeeping. It just takes way more time to sort everything out. If you’ve been mixing them, the sooner you open a separate small business bank account and keep your finances distinct, the better. If you’re ever unsure if a purchase counts as a deductible business expense, learn how the IRS differentiates personal and business expenses.

Step 4: Go paperless (seriously!)

While you’re catching up on your bookkeeping, make your life much easier by making your business paperless. As you process old paperwork, turn receipts, important documents, and other papers into digital files.

Here are some tools that can help you go digital:

- Shoeboxed: Scans and organizes your receipts, then automatically creates expense reports from what you upload.

- FileThis: A handy smartphone app for photographing and storing receipts, statements, bills, and other documents online.

- Evernote’s ScanSnap Scanner: Automatically uploads and stores all scanned documents straight to Evernote.

Step 5: Gather W-9s, 1099s, and W-2s

If you paid independent contractors and/or employees during the tax year, you’ll likely need to file some specific forms:

- For Independent Contractors: Form W-9 & Form 1099-MISC Did you pay an independent contractor more than $600 for their work during the year? If so, you’ll need a Form W-9 from them and you’ll submit a Form 1099-MISC to the IRS. A W-9 is basically a form where the contractor provides their taxpayer information to you. You use this info to issue the 1099. Simply put, the Form 1099-MISC is the tax form the IRS uses to track payments made to independent contractors. Gathering W-9s and filing 1099s involves a fair bit of work. If you’re new to this or unsure about deadlines, look up guides on “How (and When) to File a 1099” to make it smoother.

- For Employees: Form W-2 You’re required to file a Form W-2 for all your employees.

Step 6: Get a Tax Pro to review your expenses

If you’re reading this, you’re probably aiming to do all your bookkeeping and tax filing yourself. And hey, we totally get it, it often feels like the cheapest way. But we strongly recommend that you have an experienced CPA or tax professional look over your books, tax deductions, and any other financial info relevant to your tax return before you file.

This simple step helps catch errors and makes sure you’re claiming every single deduction available to your business. Plus, tax professionals can talk to the IRS for you and represent you if you ever face an audit. So, it’s a really smart idea to build a relationship with a financial pro long before you actually need their help.

If you’d rather have someone else plow through that backlog of bookkeeping for you, don’t hesitate to reach out to Sup.

We promise our Catch-Up Bookkeeping Service can help.

Ready to Transform Your Financial Management?

Let our expert team handle your bookkeeping, data automation, and visualization needs while you focus on growing your business.