Top 5 Bookkeeping software solutions: Industries, pricing and more.

Ready to Experience the +sup Difference?

Join hundreds of businesses that trust us with their financial management. Let’s discuss how we can help your business thrive.

In today’s ever changing business landscape, efficient bookkeeping is no longer a luxury but a critical necessity for survival and growth. From nascent startups to established enterprises, robust financial management underpins strategic decision-making, regulatory compliance, and ultimately, profitability. The advent of sophisticated bookkeeping software has revolutionized how businesses handle their finances, offering automation, real-time insights, and unparalleled accessibility.

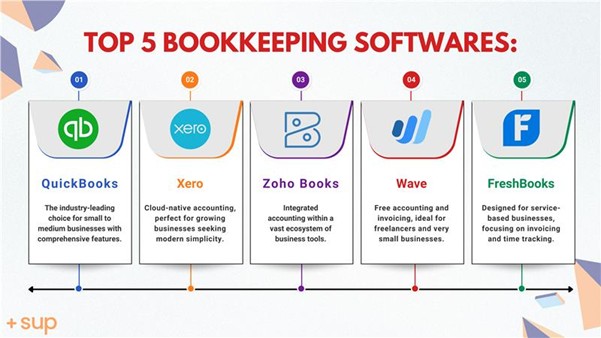

This comprehensive article delves into the top bookkeeping software solutions dominating the market: QuickBooks, Zoho Books, Xero, Wave, and a leading emergent contender, FreshBooks. We will meticulously examine their market penetration, industry prevalence, popular versions, pricing structures, and provide a concise pros and cons analysis to equip you with the insights needed to make an informed choice for your business.

A statistical overview of the current bookkeeping software solutions:

The accounting software market is a bustling ecosystem, with cloud-based solutions leading the charge. In 2024, the global accounting software market is valued at approximately USD 19.38 billion, projected to reach USD 31.25 billion by 2033, growing at a CAGR of 8.4%. North America, particularly the U.S., remains the dominant market, driven by stringent regulatory frameworks and a strong adoption of advanced functionalities. Cloud-based accounting solutions hold the largest market share, signaling a clear shift away from on-premise deployments.

While precise, real-time market share percentages for each individual software can fluctuate and are often proprietary, general trends and reported user bases provide valuable insights into their widespread adoption.

Key market insights (approximate figures):

- QuickBooks (Intuit Inc.): Commands a significant market share, particularly in the small business segment. QuickBooks Online boasts over 5 million users worldwide, while QuickBooks Desktop has over 3 million users. This indicates a dominant position, estimated to be around 37-75% of the accounting software market, depending on the specific segment and reporting methodology.

- Xero: A strong contender globally, Xero is used in over 180 countries by more than 3.7 million subscribers. While its precise market share percentage against the entire accounting software market is lower than QuickBooks, it has a substantial and growing presence, especially among cloud-first businesses.

- Zoho Books: Part of the broader Zoho ecosystem, Zoho Books has a smaller but growing market share, estimated around 0.54% of the overall accounting software market. Its strength lies in its integration with other Zoho products.

- Wave Accounting: Primarily targeting freelancers and very small businesses, Wave is known for its free core accounting features. Its market share is relatively small, with data indicating around 0.1% in the payroll category, but it’s widely used by solopreneurs.

- FreshBooks: Positioned strongly for service-based businesses, FreshBooks focuses heavily on invoicing and time tracking. While specific market share percentages are less readily available, it’s consistently ranked among the top accounting software for its target audience.

Deep dive into top Bookkeeping software solutions:

Let’s explore each software in detail, examining their industry strongholds, popular versions, pricing, and a concise pros and cons assessment.

1.QuickBooks (Intuit Inc.)

Overview: QuickBooks, developed by Intuit, is arguably the most recognized and widely used accounting software for small and medium-sized businesses globally. It offers a comprehensive suite of features for invoicing, expense tracking, payroll, inventory management, and financial reporting. Available in both desktop and cloud-based (Online) versions, it caters to a broad spectrum of business needs.

Usage Percentage: Approximately 37-75% of the accounting software market (depending on the specific market segment), with over 5 million QuickBooks Online users and 3 million QuickBooks Desktop users worldwide.

Well-known industries:

- Retail: Inventory management and sales tracking.

- Service-based businesses: Invoicing, time tracking, and project profitability.

- Construction: Job costing and project management.

- Non-profits: Fund accounting and reporting (with specialized versions).

- Freelancers & small businesses: General bookkeeping and tax preparation.

Popular versions:

- QuickBooks online (QBO): The most popular cloud-based version, constantly updated with new features and accessible from anywhere. Available in Simple Start, Essentials, Plus, and Advanced tiers.

- QuickBooks desktop: Still widely used, particularly by businesses preferring on-premise solutions or those with very specific industry needs. Includes Pro, Premier, and Enterprise editions.

Pricing (monthly, subject to change and promotions):

- QuickBooks Online Simple Start: ~$35/month

- QuickBooks Online Essentials: ~$65/month

- QuickBooks Online Plus: ~$99/month

- QuickBooks Online Advanced: ~$235/month

- QuickBooks Desktop: One-time purchase, typically ranging from a few hundred to several thousand dollars depending on the edition and user count, with annual renewal fees for support and updates.

Pros:

- Industry-standard with extensive features for various business types.

- Vast ecosystem of integrations and third-party apps.

- Robust reporting and customization options.

- Strong community support and abundant learning resources.

Cons:

- Can be expensive, especially for advanced features and multiple users.

- Customer support experiences can be inconsistent.

- Steep learning curve for some users new to accounting.

- Frequent price increases reported by users.

At Sup, we are QuickBooks certified and partner with organisations of all sizes to ensure their bookkeeping is always in pristine order.

2.Zoho Books

Overview: Zoho Books is a cloud-based accounting software that is part of the extensive Zoho Suite, offering seamless integration with other Zoho applications like CRM, HR, and project management. It provides features for invoicing, expense tracking, banking, inventory, and comprehensive reporting, making it a strong contender for businesses already invested in the Zoho ecosystem.

Usage percentage: Estimated around 0.54% of the accounting market. While smaller than QuickBooks or Xero, it is growing steadily, especially among businesses seeking an integrated suite.

Well-known Industries:

- Small to medium-sized businesses (SMBs): General accounting and operational integration.

- Consulting and IT Services: Project management and time tracking.

- E-commerce: Inventory management and sales tracking when integrated with other Zoho tools.

- Businesses using other Zoho products: Seamless integration for a unified platform.

Popular versions: Zoho Books offers various plans rather than distinct versions, with features scaling up.

- Free: Basic invoicing, expense tracking for solopreneurs.

- Standard: Includes more invoices, bills, and users.

- Professional: Adds more users, purchase orders, sales orders, and advanced project management.

- Premium: Includes multi-currency support, budgeting, and custom modules.

- Elite & Ultimate: For larger businesses with advanced inventory and warehouse management.

Pricing (monthly, billed annually for lower rates):

- Free: $0/month

- Standard: ~$15/month

- Professional: ~$40/month

- Premium: ~$60/month

- Elite: ~$120/month

- Ultimate: ~$240/month

Pros:

- Cost-effective, especially for businesses leveraging the Zoho ecosystem.

- Highly intuitive and user-friendly interface.

- Strong integration capabilities with other Zoho apps.

- Excellent customer support via chat and email.

Cons:

- Limited direct phone support.

- Some advanced reporting features might require higher plans.

- Payroll functionality is not directly built-in (often requires integration).

- User limits on lower-tier plans can be restrictive for growing teams.

Beyond QuickBooks, Sup is also highly proficient with Zoho Books, assisting in maintaining flawless financial records.

3.Xero

Overview: Xero is a popular cloud-based accounting software, particularly strong in Australia, New Zealand, and the UK, with a growing international presence. It is known for its intuitive interface, robust bank reconciliation, and extensive app marketplace. Xero focuses on simplifying financial management for small businesses and their advisors.

Usage percentage: Over 3.7 million global subscribers, indicating a substantial market presence, especially in cloud accounting. Its global footprint is growing rapidly.

Well-known industries:

- Freelancers & Startups: Simple, user-friendly interface for basic needs.

- Creative Agencies & Marketing Firms: Project tracking and invoicing.

- Retail & E-commerce: Inventory management and sales integration.

- Professional Services: Time tracking and client billing.

- Small to Medium-sized Businesses (SMBs): General cloud accounting.

Popular versions: Xero offers distinct pricing plans rather than traditional “versions.”

- Early: Basic features for very small businesses.

- Growing: Unlimited invoices, bills, and bank reconciliation.

- Established: Includes multi-currency, advanced reporting, and project management.

Pricing (monthly, subject to change and promotions):

- Early: ~$20/month (often discounted for first few months)

- Growing: ~$47/month (often discounted for first few months)

- Established: ~$80/month (often discounted for first few months)

- Note: Prices can vary slightly by region.

Pros:

- User-friendly and aesthetically pleasing interface.

- Excellent bank reconciliation features.

- Unlimited users across all paid plans.

- Extensive app marketplace for third-party integrations.

Cons:

- Customer service experiences can be mixed (no direct phone support in some regions).

- Payroll is an add-on, increasing overall cost.

- Some users find the reporting less customizable than QuickBooks.

- Price increases have been a concern for some long-term users.

And for Xero, Sup is also expertly skilled, helping organisations achieve impeccable financial health and streamlined operations.

4.Wave Accounting

Overview: Wave Accounting is a unique offering in the bookkeeping software landscape as it provides a comprehensive suite of accounting, invoicing, and receipt scanning tools for free. It generates revenue primarily through its integrated payment processing and payroll services. It’s an excellent choice for freelancers, sole proprietors, and very small businesses with straightforward financial needs.

Usage percentage: While exact market share is difficult to pinpoint for the free accounting component, it has a significant user base among micro-businesses. Its payroll market share is around 0.1%, indicating its niche.

Well-known industries:

- Freelancers: Invoicing and basic expense tracking.

- Sole proprietors: Managing personal and business finances.

- Consultants & artists: Simple billing and income/expense tracking.

- Very small businesses: Businesses with minimal employees and simple accounting requirements.

Popular versions: Wave offers a straightforward structure with a free core accounting platform and paid add-on services.

- Starter plan: Free core accounting, invoicing, receipt scanning.

- Pro plan: Paid plan primarily for advanced payroll and payment features.

Pricing:

- Accounting, Invoicing, Receipt Scanning: Free

- Payment Processing Fees:

- Credit Card: 2.9% + $0.60 per transaction (Visa, Mastercard, Discover); 3.4% + $0.60 per transaction (American Express)

- Bank Payments (ACH): 1% per transaction ($1 minimum fee)

- Wave payroll: ~$40 monthly base fee + $6 per active employee/contractor per month (pricing varies by state/country)

- Advisor services: Paid add-on for bookkeeping, payroll, and tax coaching.

Pros:

- Free core accounting, invoicing, and receipt scanning.

- User-friendly interface, especially for non-accountants.

- Unlimited users for the free accounting software.

- Excellent for managing simple finances.

Cons:

- Limited advanced features like inventory management or project tracking.

- Customer support can be slower for free users.

- Reliance on paid add-ons for essential services like payroll and advanced support.

- Fewer direct third-party integrations compared to competitors.

Sup is also fully adept in Wave bookkeeping, ensuring all organisations keep their books perfectly balanced and simple.

5.FreshBooks

Overview: FreshBooks is a robust cloud-based accounting solution specifically designed for service-based businesses, freelancers, and small businesses. It excels in invoicing, time tracking, expense management, and project profitability. Its user-friendly interface and strong emphasis on client billing make it a top choice for those who frequently bill clients for their time and services.

Usage percentage: While a precise percentage isn’t readily available, FreshBooks is a top contender and Editors’ Choice for service-based businesses, indicating a strong presence within that niche.

Well-known industries:

- Freelancers & independent contractors: Time tracking, invoicing, expense management.

- Consulting & professional services: Project profitability, client retainers.

- Creative agencies & designers: Project management, recurring invoices.

- IT services: Billing for hours and services rendered.

- Any service-based small business: Businesses primarily selling time or expertise.

Popular versions: FreshBooks offers tiered plans that scale with the number of billable clients.

- Lite: For very small businesses with limited billable clients.

- Plus: Adds automated invoices, late payment reminders, and more billable clients.

- Premium: For growing businesses, offering more billable clients and advanced features.

- Select: Custom pricing for larger businesses with specific needs.

Pricing (monthly, billed annually for discounts):

- Lite: ~$21/month (often discounted for the first few months)

- Plus: ~$38/month (often discounted for the first few months)

- Premium: ~$65/month (often discounted for the first few months)

- Select: Custom pricing

Pros:

- Exceptional invoicing and time-tracking capabilities.

- Intuitive and easy-to-use interface.

- Strong focus on project profitability and client management.

- Good mobile app for on-the-go management.

Cons:

- Less robust inventory management for product-based businesses.

- Limited customization options for reports compared to more comprehensive solutions.

- Higher cost per additional user compared to some competitors.

- Bank reconciliation not included in the lowest-tier plan.

And for FreshBooks, as an emerging platform, Sup is already well-versed, ready to seamlessly manage the accounts for growing businesses.

A descriptive chart:

Selecting the right bookkeeping software is a critical decision that impacts operational efficiency and financial health. The following descriptive chart outlines key considerations and the strengths of each software in those areas.

Conclusion:

The choice of bookkeeping software is a strategic one, deeply intertwined with the specific needs, size, and future aspirations of your business.

While QuickBooks remains a dominant force with its comprehensive features, Xero offers a modern, user-friendly cloud experience. Zoho Books provides an affordable and integrated solution, particularly for businesses within the Zoho ecosystem. Wave stands out as an excellent free option for freelancers and micro-businesses, while FreshBooks is the undisputed champion for service-based companies prioritizing invoicing and time management.

Each of these platforms offers unique advantages, but the underlying principle of efficient financial management remains constant. Understanding their nuances, as highlighted in this article, empowers businesses to select a tool that not only streamlines their current bookkeeping processes but also supports their growth trajectory.

Our team at SUP is certified in all these powerful bookkeeping tools and possesses extensive expertise across various industries. Whether you’re a burgeoning startup, a growing SMB, or an established enterprise, we are equipped to provide comprehensive support, from initial setup and customization to ongoing management and strategic financial insights. Partner with us to unlock the full potential of your chosen bookkeeping software and elevate your financial operations.

Ready to find your perfect fit?

Let’s schedule a free call today to explore your needs and show you how Sup can elevate your financial operations.

Ready to Transform Your Financial Management?

Let our expert team handle your bookkeeping, data automation, and visualization needs while you focus on growing your business.